Description

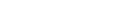

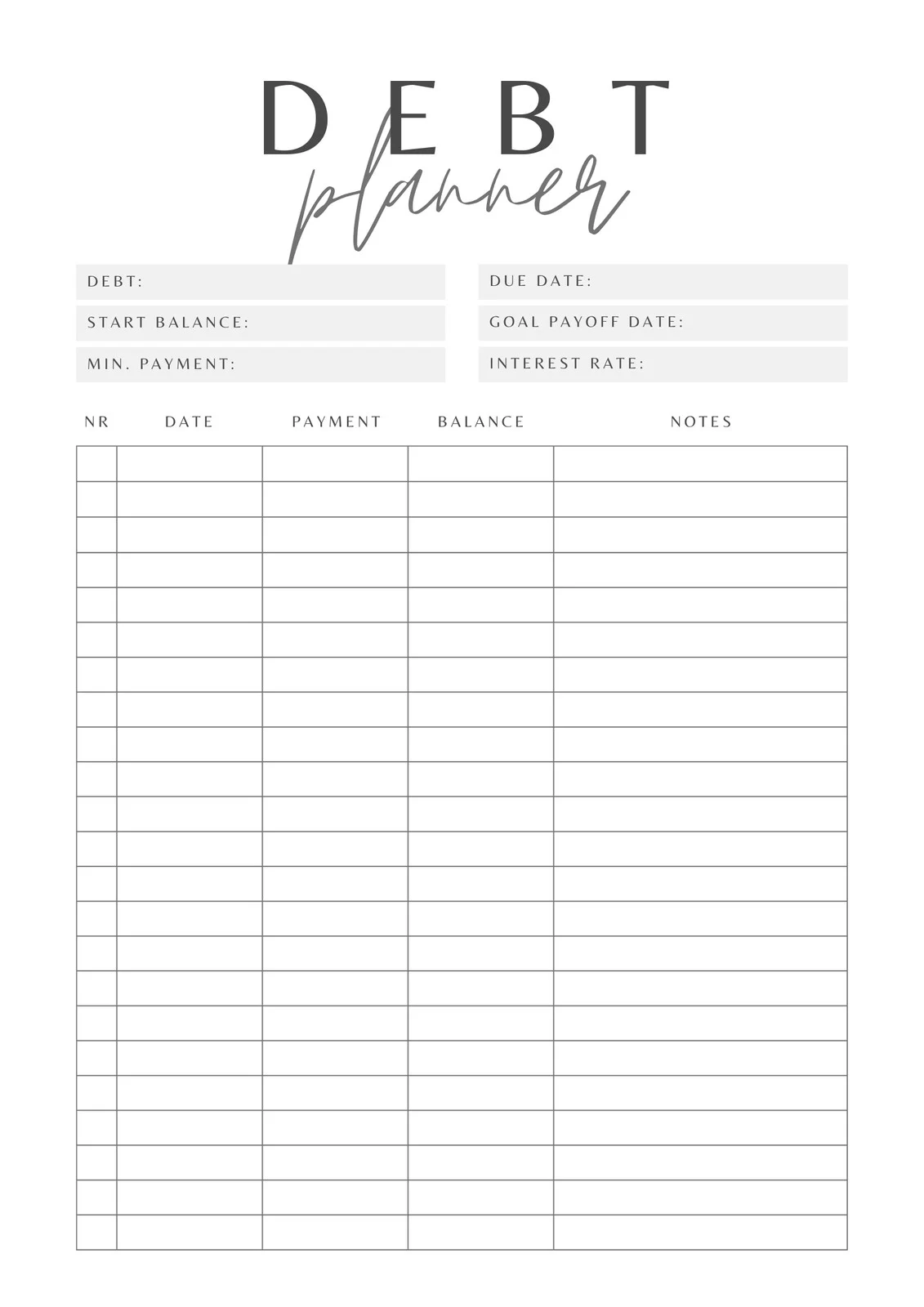

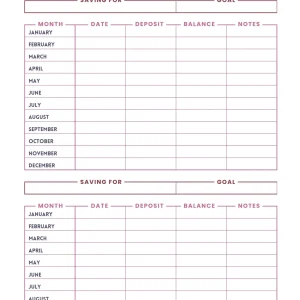

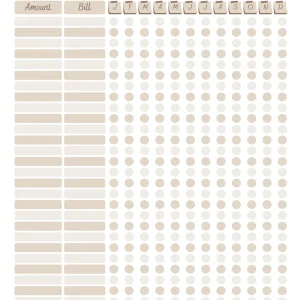

The Debt Payoff Tracker is an essential tool for anyone determined to take control of their financial future and eliminate debt with clarity and confidence. Designed with proven strategies like the snowball or avalanche methods in mind, this printable helps you stay motivated and organized as you track payments across all your debts—credit cards, student loans, auto loans, personal loans, and more. It includes a master debt list where you can document the balance, minimum payment, interest rate, and due date for each debt. You’ll find monthly and bi-weekly payment tracking sections, visual progress bars for each account, and a goal summary page where you can forecast your payoff dates based on different payment scenarios. Use the printable to compare payment strategies, track extra payments, and celebrate milestones when balances reach zero. This tracker reduces the anxiety that often accompanies debt by providing a structured, goal-oriented layout that encourages consistency and financial discipline. Whether you’re paying off one large balance or juggling multiple accounts, this printable offers both clarity and encouragement. Print it out monthly or store it in your finance binder for easy reference during budget reviews.

Izuchukwu –

This Debt Payoff Tracker is exactly what I needed to get a handle on my finances. The snowball and avalanche method options are fantastic, and seeing the visual progress really keeps me motivated. The payment history logs help me stay organized, and being able to customize the timelines makes the whole process feel much more achievable. I’m finally feeling in control of my debt!

Aniekan –

The Debt Payoff Tracker is exactly what I needed to get serious about tackling my debt. The visual progress trackers are incredibly motivating and the ability to customize the timeline really helped me create a plan that fits my specific situation. I especially appreciate the payment history logs which make it easy to see how far I’ve come and stay organized. This planner has made a seemingly overwhelming task feel manageable and I’m confident I’ll reach my debt-free goals using it.

Linus –

This Debt Payoff Tracker is exactly what I needed to finally get serious about tackling my debt. The visual progress indicators are incredibly motivating and the payment history logs keep me organized. Being able to customize the payoff timelines based on my preferred method has made the process feel much more manageable and less overwhelming. I’m already seeing progress and feel empowered to achieve my debt-free goals!

Ebere –

This Debt Payoff Tracker is exactly what I needed to finally get serious about tackling my debt. The visual progress trackers are incredibly motivating, and having a clear payment history log helps me stay organized and on top of everything. I love that I can customize the payoff timeline to fit my own financial situation. It’s made a previously daunting task feel much more manageable and achievable, and I’m already seeing progress.

Ogechukwu –

This Debt Payoff Tracker has been incredibly helpful in organizing my debt repayment journey. The visual progress indicators are super motivating, and being able to log my payment history keeps me on track. The option to choose between snowball and avalanche methods is fantastic, and the customizable timeline allows me to set realistic goals. I feel more in control of my finances than ever before thanks to this tool!